utah solar tax credit form

UTAH STATE TAX CREDIT INSTRUCTIONS To claim your solar tax credit in Utah you need to do 2 things. To claim your solar tax credit in Utah you will need to do 2 things.

Understanding The Utah Solar Tax Credit Ion Solar

In 2022 the maximum tax credit will be 800.

. Below you will find instructions for both. According to the Utah State Tax Commission httpincometaxutahgovcreditsrenewable-energy-systems You can get Form TC-40E Renewable Residential and Commercial Energy Systems Tax Credits from the Governors Office of Energy Development with their certification. 261 rows Energy Systems Installation Tax Credit.

Renewable Energy Systems Tax Credit. Well use 25000 gross cost of a solar energy system as an example. Free Online Solar Energy Installation Resource.

Steps for Utilizing the Utah Solar Tax Credit. Discover Local Solar Pros In Utah Today. Only the original purchaser of the new home qualifies for the tax credit.

Claim the Renewable Residential Energy System Credit. The maximum Re-newable Residential Energy Systems Credit credit 21 for solar power systems installed in 2021 is 1200. 2 File for the TC-40e form you request this and then keep the record.

If you install a solar panel system on your home in Utah the state government will give you a credit towards next years income taxes to reduce your solar costs. Attach to Form 1040 1040-SR or 1040-NR. We are accepting applications for the tax credit programs listed below.

The Utah solar tax credit officially known as the Renewable Energy Systems Tax Credit covers up to 25 of the purchase and installation costs for residential solar PV projects capped at 1600 whichever is less. Alternative Energy Development Incentive. Utah Renewable Energy Systems Tax Credit RESTC Program.

Do not send this form with your return. 1 Claim the credit on your TC-40a form submit with your state taxes. Get form TC-40E Renewable Residential and Commercial Energy Systems Tax Credits from the Governors Office of Energy Development with their certification stamp.

You can claim 25 percent of your total equipment and installation costs up to 800. Welcome to the Utah energy tax credit portal. North Temple Suite 3610 Box 146480 Salt Lake.

Learn more and apply here. Homeowners with solar systems may qualify for a one-time personal tax credit. Ad Take Advantage Of Solar Tax Credit For 2022.

If audited provide your TC-40E. Get Up To 4 Free Solar Quotes By Zip. Install a solar energy system.

Ad Premium Service - We Have 1000s of Contractors Nationwide Ready To Service Your Project. Form 5695 calculates tax credits for a variety of qualified residential energy improvements including geothermal heat pumps solar panels solar water heating small wind turbines and fuel cells. Get Qualified Instantly Compare Quotes.

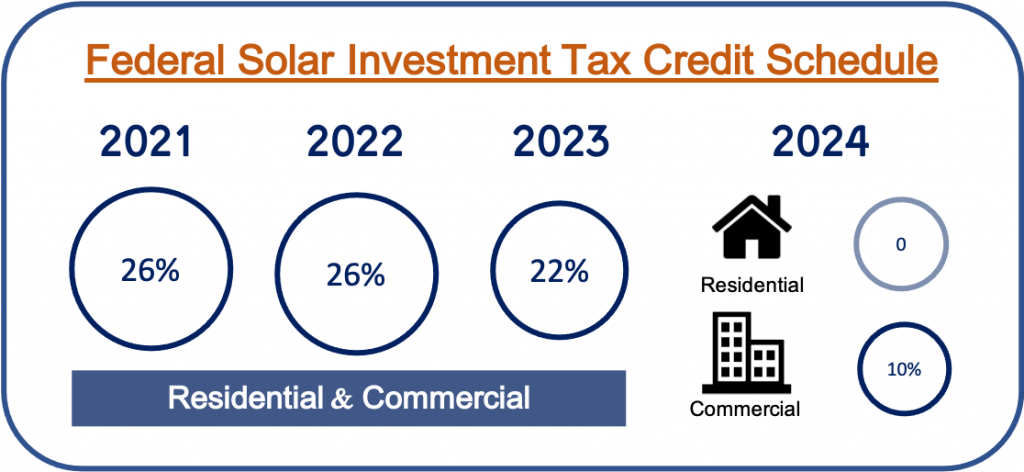

For installations completed until 2023 the tax credit is 26 of solar costs. Renewable energy systems tax credit. To determine if your system or system components and installation qualify for the tax credit submit a written application complete with signatures and photocopies of receipts to the Utah Energy Office.

Utah solar customers would be wise to invest in solar before the available funding is no longer within their reach. Receive and save your TC-40E. Create an account with the Governors Office of Energy Development OED Complete a solar PV application.

Solar Energy Systems Phase-out. High Cost Infrastructure Tax Credit. Enter your energy efficiency property costs.

Claim the credit on your TC-40a form submit with your state taxes. Application forms can be obtained on the Internet wwwenergyutahgov or from the 1594 W. Your social security number.

The amount of the credit depends on the installation year and cost of your system. Form 5695 2021 Residential Energy Credits Department of the Treasury Internal Revenue Service Go to wwwirsgovForm5695 for instructions and the latest information. This form is provided.

Calculate Your Savings In 2 Minutes. Ad Free Utah Solar Quotes. Names shown on return.

Step-by step instructions for using IRS Form 5695 to claim the federal solar tax credit. For installations completed in 2021 the maximum tax credit will be 1200. Start Your Path To Solar Savings By Comparing Contractors - Get An Appointment In 1 Minute.

Download your instructions form here. Solar PV systems installed on your home or business. If you qualify obtain the latest copy of.

Utah offers a suite of tax credits for commercial projects that span significant infrastructure projects as well as renewable energy oil and gas and alternative energy installations. Starting in 2021 it will resume its yearly phase down until this tax credit reaches zero at the end of 2023. Special Needs Opportunity Scholarship Program.

Enter the following apportionable nonrefundable credits credits that must be apportioned for nonresidents and part-year residents that apply. Attach TC-40A to your Utah return. Thats in addition to the 26 percent federal tax credit for solar not a bad deal for a system that can.

Utah Solar Tax Credit. File for the TC-40e form you request this. Log in or click Register in the upper right corner to get started.

Check Utah Solar Panel Incentives for 2022. The 2020 legislature passed HB 4003 creating a nonrefund-able tax credit for donations made to the Special Needs. To find out the initial cost of your solar system please contact your community sales representative.

Add the amounts and carry the total to TC-40 line 24. Write the code and amount of each apportionable nonrefundable credit in Part 3. Keep the form and all related documents with your records to provide the Tax Commission upon request.

Utahs solar tax credit currently is frozen at 1600 but it wont be for long. Where do I enter the information to receive the Utah state tax credit for solar. Renewable Energy Systems Tax Credit.

The Utah residential solar tax credit is also phasing down. The residential Solar PV tax credit is phasing out and currently installations completed in 2020 the tax credit is calculated as 25 percent of the eligible system cost or 1600 whichever is less for installations on residential dwelling units.

How Long Do Solar Panels Last Blue Raven Solar

China Dominates The Solar Industry Can The U S Catch Up Marketplace

Understanding The Utah Solar Tax Credit Ion Solar

Solar Tax Credit Details H R Block

Solar Tax Exemptions Sales Tax And Property Tax 2022

Information On Solar Energy Federal Tax Credits Northern Arizona Wind Sun

Solar Incentives In Utah Utah Energy Hub

Form 5695 Instructions Claiming The Solar Tax Credit Energysage

Solar Investment Tax Credit Basics And Eligibility Intermountain Wind And Solar

Federal Solar Tax Credit Guide Atlantic Key Energy

Simple Diy Solar Powered Projects For Preppers Shtfpreparedness Solar Projects Renewable Energy Solar

How Does The Utah Solar Tax Credit Work Iws

A Colorado Steel Mill Is Now The World S First To Run Almost Entirely On Solar

What Sets Sunpower Solar Panels Apart Bluesel Home Solar

Solar Tax Credit What If Your Tax Liability Is Too Small Palmetto

Federal Solar Tax Credit 2022 How It Works How Much It Saves

Free Solar Energy Estimate In Arkansas Atlantic Key Energy

Solar Energy Bureau Of Land Management

We Could Power The Entire World By Harnessing Solar Energy From 1 Of The Sahara